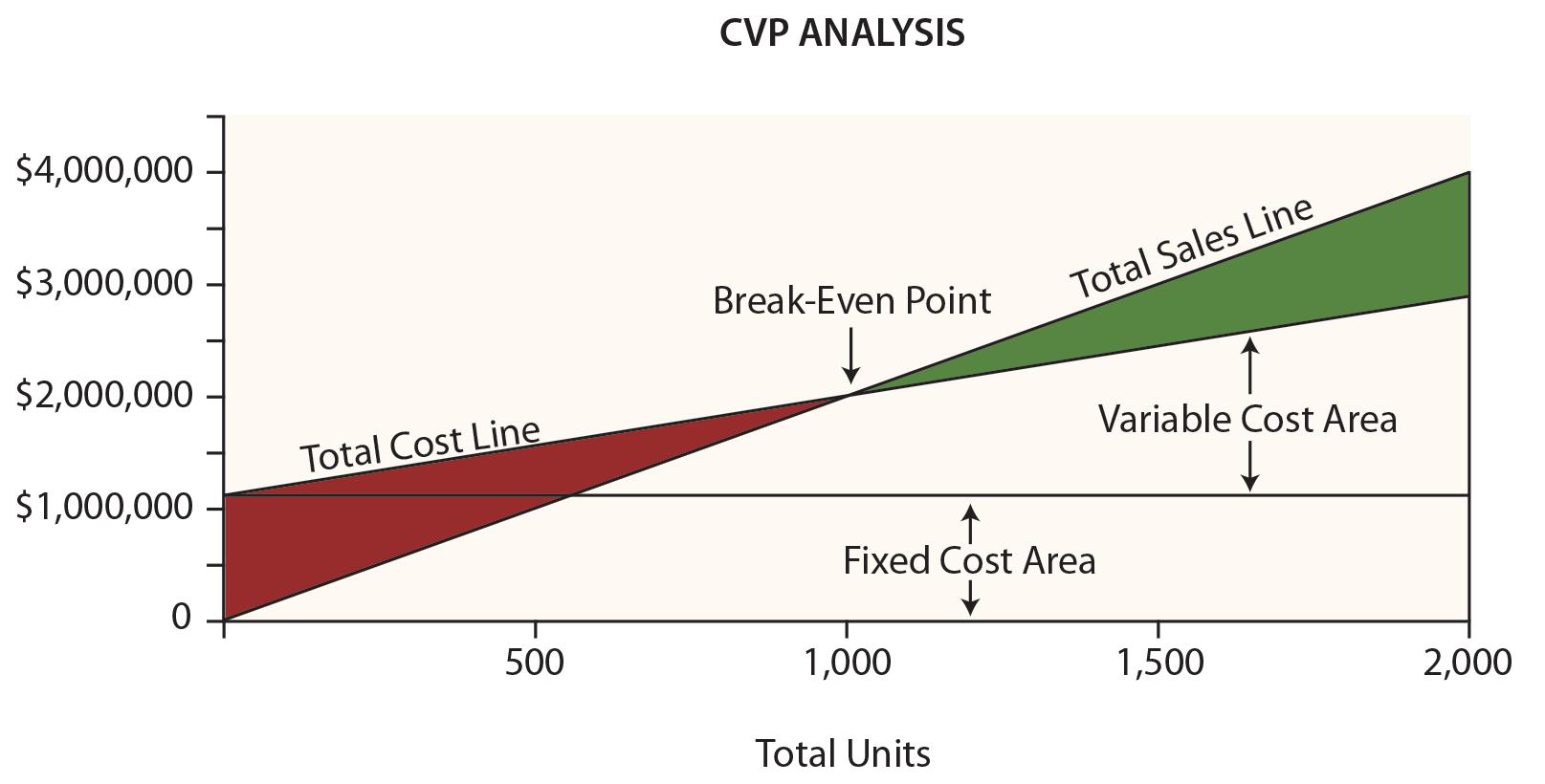

This relationship will be continued until we reach the break-even point, where total revenue equals total costs. If it subsequently sells units, the loss would be reduced by $150 (the contribution margin) for each unit sold. This loss explains why the company’s cost graph recognised costs (in this example, $20,000) even though there were no sales. It would realize a loss of $20,000 (the fixed costs) since it recognised no revenue or variable costs. For example, assume that in an extreme case the company has fixed costs of $20,000, a sales price of $400 per unit and variable costs of $250 per unit, and it sells no units. The basic theory illustrated in the diagram above is that, because of the existence of fixed costs in most production processes, in the first stages of production and subsequent sale of the products, the company will report a loss. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license) Using these assumptions, we can begin our discussion of CVP analysis with the break-even point.īreak-Even Point. For example, if we are a beverage supplier, we might assume that our beverage sales are 3 units of coffee pods and two units of tea bags.

In the case of a company that sells multiple products, the sales mix remains constant.In the case of manufacturing businesses, inventory does not change because we make the assumption that all units produced are sold.Selling price per unit remains constant and does not increase or decrease based on volume (i.e., customers are not given discounts based on quantity purchased).In this example, the production capacity between 1,800 and 2,000 would be an expense that currently would not provide additional contribution toward fixed costs. While they might be able to add an extra production shift and then produce 1,800 units a month without buying an additional machine that would increase production capacity to 2,000 units a month, companies often have to buy additional production equipment to increase their relevant range. If they decided that they wanted to produce 1,800 units a month, they would have to secure additional production capacity. For example, if a company has the capability of producing up to 1,000 units a month of a product given its current resources, the relevant range would be 0 to 1,000. In other words, fixed costs remain fixed in total over the relevant range and variable costs remain fixed on a per-unit basis. Costs are linear and can clearly be designated as either fixed or variable.Our CVP analysis will be based on these four (4) assumptions:

For example, while we typically assume that the sales price will remain the same, there might be exceptions where a quantity discount might be allowed. However, while the following assumptions are typical in CVP analysis, there can be exceptions. It is important, first, to make several assumptions about operations in order to understand CVP analysis and the associated contribution margin income statement. Those concepts can be used together to conduct cost-volume-profit (CVP) analysis, which is a method used by companies to determine what will occur financially if selling prices change, costs (either fixed or variable) change, or sales/production volume changes.

#Break even point formula in cost accounting how to#

In a previous section, you learned how to determine and recognise the fixed and variable components of costs, and now you have learned about contribution margin. Mitchell Franklin Patty Graybeal Dixon Cooper and Amanda White Assumptions required for cost-volume-profit analysis

0 kommentar(er)

0 kommentar(er)